When it comes to buying a home in North Carolina, there are a number of costs that you need to be aware of in addition to the purchase price of the property. One of these costs is the due diligence fee. In this blog, we will explore what due diligence fees are, how they work in North Carolina, and what you should keep in mind when it comes to these fees.

What Is A “Due Diligence” Offer To Purchase?

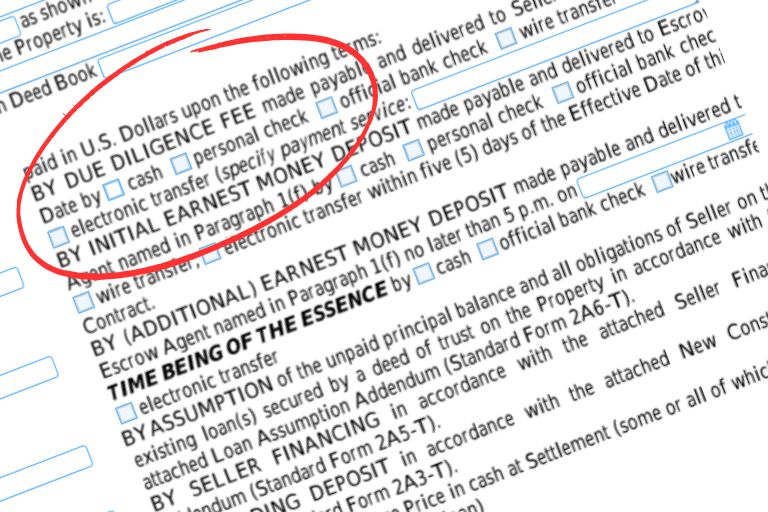

The “due diligence” form of the Offer to Purchase and Contract (Form 2-T), jointly approved by NC REALTORS® and the NC Bar Association, was introduced in January 2011. The primary purpose of adopting a due diligence form of contract was to reduce disputes between the parties by greatly simplifying the old contract through the elimination of many of the separate contract contingencies relating to repairs, financing, and insurance, among others. The complicated structure of the old contract was replaced by a due diligence process that allows a buyer to investigate the property and the availability of any necessary financing for a negotiated Due Diligence Fee and to terminate the contract for any reason or no reason prior to the end of a negotiated Due Diligence Period. The result is a simplified form that puts focus on the business terms of the contract: the purchase price, the amounts of any Due Diligence Fee and Earnest Money Deposit, the length of the Due Diligence Period, and the Settlement/Closing Date. This contract provides flexibility for the parties to negotiate based on both individual needs and current market conditions.

The long-term health of the real estate marketplace depends on allowing market forces to influence contract terms and spur or curtail growth in housing supply to meet demand. Form 2- T contract is a balanced, market-sensitive form that does not impose artificial constraints on consumers. It affords a buyer a reasonable opportunity to conduct the investigations necessary for such a significant financial expenditure, investigations which are expected of a buyer under North Carolina law, and it compensates a seller for taking the property off market during the investigation period.

So Then, What Are Due Diligence Fees?

Due diligence fees are fees that are paid by the buyer to the seller of a property during the due diligence period. The due diligence period is typically a period of time agreed upon by the buyer and the seller during which the buyer has the opportunity to investigate the property and ensure that they are satisfied with its condition and any other relevant factors prior to closing on the purchase.

During the due diligence period, the buyer can conduct inspections, surveys, and other investigations to ensure that the property is in the condition they expect it to be in. If the buyer discovers any issues with the property during this period, they can request to negotiate with the seller to either have the issues fixed or to adjust the finances of the purchase accordingly.

Since the Due Diligence Fee is paid directly to the seller, this is a significant part of the seller’s consideration when evaluating contract acceptance.

One important thing to keep in mind is that due diligence fees are typically non-refundable, even if the buyer ultimately decides not to go through with the purchase of the property. This means that if the buyer pays a due diligence fee and then decides not to proceed with the purchase for any reason, they will not be able to get the fee back. However, if the buyer and seller ultimately proceed with the sale of the property, the due diligence fee will be credited towards the purchase price of the property.

Stay Focused

Due diligence fees are negotiable: As mentioned, the amount of the due diligence fee is negotiable between the buyer and the seller. This means that it is important to carefully consider what a reasonable amount is based on the property and the length of the due diligence period. Other factors to consider are whether you are facing a multiple offer scenario and want your offer to stand out from your competition.

Since the Due Diligence Fee is paid directly to the seller, this is a significant part of the seller’s consideration when evaluating contract acceptance. Obviously the Offer Price, Earnest Money Deposit and Closing Date are all important factors to sellers; having a strong Due Diligence Fee can really make your offer compelling since it shows how committed a buyer is to following through on their offer.

Am I Taking All The Risk As A Buyer?

It’s easy to think that since the buyer is paying the Due Diligence Fee directly to the seller and it is non-refundable, they are exposed to the greatest risk. However, this requires one to examine the transaction more carefully so they can better understand the forces at play with the Due Diligence Contract. Should a buyer terminate their contract, they would loose their Due Diligence Fee. But the seller would also have to put the house back on the market to try and fetch another contract.

This is where a seller could be financially disadvantaged by the buyers termination. Any subsequent buyers would know that a buyer terminated the contract. This creates another level of scrutiny and critical evaluation by buyers and very likely would result in lower offer prices than was originally accepted.

So while a buyer may feel they are taking all the risk, the purpose of the Due Diligence Contract is that both parties share the risk together. Be sure to consult your real estate agent who can guide you accordingly.

In Conclusion

In conclusion, due diligence fees are an important consideration when it comes to buying a home in North Carolina. By understanding what they are, how they work, and what to keep in mind, you can ensure that you are making an informed decision when it comes to the purchase of your new home. For additional resources, check out this Q&A on Due Diligence Fees from the North Carolina Real Estate Commission.