In a recent article published by Axios, the author, Felix Salmon, presents a perspective on America’s high homeownership rate, suggesting that it is hindering economic progress and contributing to a national housing crisis. While the article touches upon several valid points, it fails to adequately address a crucial factor influencing homeownership trends in the current market: the historically low interest rates during the Covid-19 period and their subsequent rise.

The Impact of Low Interest Rates

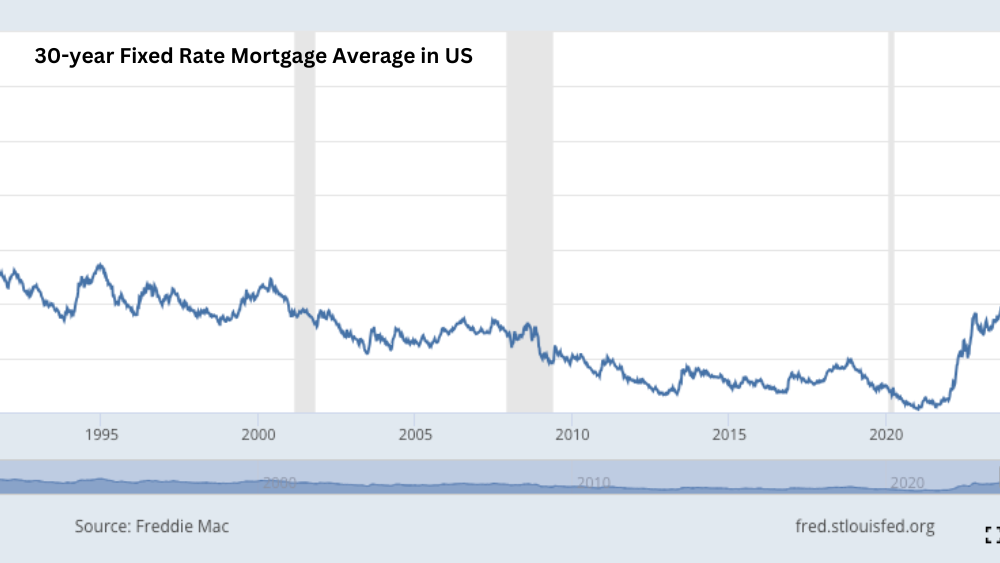

During the Covid-19 pandemic, interest rates plummeted to record lows, providing homeowners with an unprecedented opportunity to secure mortgages at extremely attractive rates. Many homeowners seized this chance, locking in rates that significantly reduced their monthly mortgage payments. However, as we have transitioned out of the pandemic, interest rates have begun to rise once again, creating a stark contrast between the cost of current mortgages and those secured during the Covid period. Additionally, home prices rose sharply during the same period as housing demand was at an all time high and inventory was not able to keep up with the demand.

The Cost of Moving in Today’s Market

The article from Axios seems to overlook the financial implications of this interest rate disparity for homeowners considering a move. With current mortgage rates substantially higher than those from the Covid period, homeowners are facing the prospect of significantly higher monthly payments for a new mortgage, even if the value of the new home is comparable to their current residence. This cost difference is a critical factor that many homeowners are weighing before deciding to stay put, rather than an outright reluctance to move.

Addressing the Misconceptions

It is essential to clarify that the reluctance to move is not a result of homeowners being “locked” into their homes due to a lack of desire for change or mobility, as the Axios article might suggest. Instead, it is a calculated financial decision based on the stark economic realities of the current housing market. Homeowners are acutely aware of the financial benefits of their low-rate mortgages and are understandably hesitant to give that up, especially when the alternative is a significantly more expensive monthly payment.

The Need for a Balanced Perspective

While the Axios article raises valid concerns about the implications of high homeownership rates and the need for mobility and flexibility in housing, it is crucial to approach this issue with a balanced perspective. Acknowledging the financial realities and the impact of interest rate changes on homeownership decisions is essential to understanding the current trends and developing effective solutions.

In conclusion, as we navigate the post-Covid housing market, it is vital to recognize the significant impact that low interest rates during the pandemic have had on homeownership trends. The decision to stay in one’s home is not solely a matter of personal preference or resistance to change, but a complex financial decision influenced by the current economic climate. By acknowledging this, we can work towards a more comprehensive understanding of the housing market and develop strategies that address the needs of homeowners and potential buyers alike.